“Where’s My Refund?” is updated once daily, usually overnight, so checking it more often will not produce a different result.

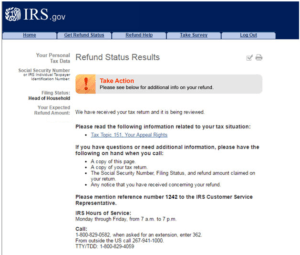

Once the tax return is processed, “Where’s My Refund?” will tell a taxpayer when their refund is approved and provide a date when they can expect to receive it. That time extends to four weeks if a paper return is mailed to the IRS, which is another reason to use IRS e-file and direct deposit. Within 24 hours of filing a return electronically, the tool can tell taxpayers that their returns have been received. Alternatively, taxpayers may call 80 for the same information. All that is needed is the taxpayer’s Social Security number, tax filing status (single, married, head of household) and exact amount of the tax refund claimed on the return. Taxpayers can avoid the rush by using the “Where’s My Refund?” tool. IRS telephone assistors can only research a refund’s status if it has been 21 days or more since the taxpayer filed electronically, six weeks since they mailed a paper return or if “Where’s My Refund?” directs a taxpayer to call.

But the time around Presidents Day is a peak period for telephone calls to the IRS, resulting in longer than normal hold times. After processing your ITR, the CDC processes your income tax refund within 20 to 45 days. Questions about tax refunds are the most frequent reason people call the IRS. The fastest way to get a refund is to use IRS e-file and direct deposit. I feel the next step it to contact my MP and perhaps see if this might be something that the media might be interested in to bring this matter to the attention of the general public.The IRS says that more than 70 percent of taxpayers will receive a refund this year. It appears that the department handling tax refunds is exempt from freedom of information requests and as it does not provide updates, then those waiting for refunds have no way of knowing when these will received. This is my final source of income for the year and the constant delays will result in my mortgage provider foreclosing on me by the end of this month. The refund related to overpayment of tax by the pension fund provider and is in excess of £12k. I fully expect to shortly receive notification that the payment will be further delayed without any reason being given. There is no way of anyone (either internal or external) can check on the progress of the security check and any actions which might be outstanding. I have called the number advised by HMRC Admin 17 on numerous occassions and every time I am advised that the team dealing with security checks cannot be contacted for updated information, either by the client or any of the internam HMRC teams.

This date has passed and still no refund. I have been trying since May to get a refund on overpayment of tax by a pension fund provider and I received a letter advising a 10 week delay and which provided a settlement date. Please can someone get a grip and sort this out, the amount of money you owe me (and are refusing to pay) is pennies in the grand scheme of things. I keep being told that "someone will get back to me" but yet again, I get an R38 to fill in. If I was to delay paying my tax by 7 months you'd be sending me all sorts of threatening letters and messages. I'm sure they're doing the best they can, but I just want an answer as it's been nearly 7 months! A bit of a joke really. I keep being sent the same form (R38) over and over again which I know is a delay tactic that I keep filling in and returning but still nothing happens! I have called 03 many times, but I may as well call my neighbor as they are no help whatsoever. Help!! I am still waiting for a tax refund from my self assessment which was submitted by my accountant in January!! I know we've all been through a terribly tough 18 months during the pandemic, but this is why I need my refund now! Times are tough and the money you OWE ME will help ease the pressure.

0 kommentar(er)

0 kommentar(er)